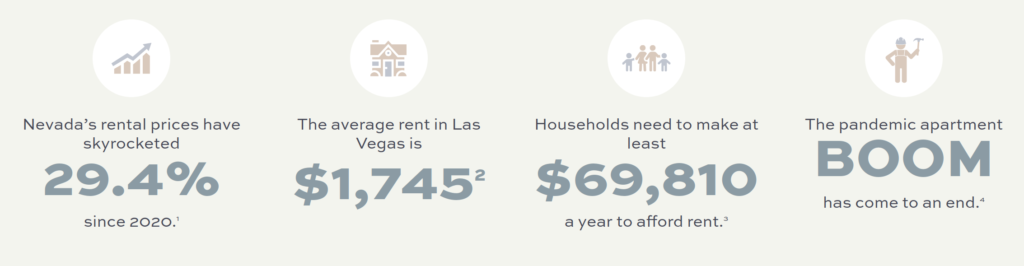

It’s no secret that we’re facing a housing affordability crisis. According to Nevada Realtors, rents are up nearly 30% and most people making less than the median household income in Reno can’t afford their rent. RSTU knows firsthand that tenants in Reno and Sparks are feeling the pain.

Nevada Realtors claim that “Rent Control” restricts housing development, drives up costs, and will somehow prevent your landlord from keeping your unit in a habitable condition. Let’s debunk these one-by-one.

Rent Stabilization, by Definition, Keeps Rents Low

Rent Stabilization laws, like SB 426, cap rent increases at 5% per year. So, by definition, rent stabilization laws like SB 426 would keep rent increases lower.

The truth is landlords know that moving is difficult, expensive, and sometimes impossible for tenants. Once you have moved into their unit, they know they can raise your rent by as much as 5%, 10%, or 20% per year– rates that significantly outpace inflation. This amounts to price-gouging, where landlords exploit the leverage they have to extract every dollar they can out of you. It’s just business to them, but to us, our homes hang in the balance.

ProPublica and the Reno Gazette-Journal recently found that many landlords use advanced analytics software to engage in price-fixing, raising rents for everyone.

Software like RealPage allows landlords to utilize your personal data to determine “highest rent an apartment applicant is able to pay” to extort renters for the maximum rents we can bear. In many cases, this is more than renters can afford and ignores the basic fact that housing is a necessity that we cannot opt out of.

Landlords, developers, and real estate professionals use the term “Rent Control” to scare you. In reality, “Rent Control” measures are laws that prevent landlords from extorting tenants. Between 2000 and 2020, the US inflation rate remained below 4%, so a 5% cap on annual rent increases (like SB 426) would simply prevent landlords from price gouging beyond inflation.

Rent Stabilization Has No Impact on Development

For a long time, critics of rent stabilization have theorized that rent regulations reduce the supply of housing units by disincentivizing investment in the community. Despite decades of research, the evidence simply does not back this up.

For example, many anti-rent stabilization publications like this recent literature review make bold statements, but upon inspection, their sources do not back them up. The author claims a causal relationship between rent control and high costs in San Francisco and Palo Alto. In the fine print, however, the author admits their “analysis of Census data from 2010-2019 did not find a statistically significant impact on the availability of rental units in the city.” While we know rent control has prevented many San Franciscans from getting priced out of their neighborhoods, it seems that the facts do not support the theory that rent control increased rents in San Francisco.

The truth is that rent stabilization laws exist to protect tenants from frivolous price gouging. These laws have no affect on property development because landlords can still make healthy profits without raising rents in excess of 5% per year.

Many housing affordability experts agree. In The Affordable City, author Shane Phillips writes “anti-gouging regulations set at a reasonable rate-as in Oregon and California-would have no appreciable impact on new housing development.”

RSTU also supports “all of the above” housing solutions proposed by Strong Towns and other affordable housing advocates. We want Reno and Sparks to adopt zoning code and regulations that promote building apartments, town homes, and houses of all shapes and sizes. Rent stabilization, when considered alongside other policy changes, will provide a diverse portfolio of affordable housing for everyone.

Landlords are Required by Law to Maintain Your Unit

When Nevada Realtors say “Studies show that rent control increases landlords’ INABILITY to keep up with repairs,” they are lying. The study they cite, The Effect of Rent Control on Housing Quality Change, does not establish a causal relationship between rent control and and housing quality. The abstract says the results “suggest the need for additional investigation of this issue,” which plainly admits a lack of statistical evidence.

Fact: In Nevada, landlords are legally required to maintain rental properties in a habitable condition, including waterproofing, weather protection, plumbing, heating, electrical systems, garbage disposal, pest control, and structural integrity. Rent stabilization proposals simply have nothing to do with these laws.

Renters know firsthand that landlords only make bare minimum repairs when they are legally required or when it is necessary to protect the value of their investment. But don’t take our word for it- there are communities like r/realestateinvesting where landlords publicly discuss these business strategies and how profitable they are. The truth is that landlords operate very profitable businesses and lack financial incentives for making repairs. They make more money when they don’t have to pay to fix stuff.

We should also mention that landlords receive numerous government subsidies and incentives for their businesses. For example, the IRS allows developers to depreciate residential rental properties over 27.5 years. That means developers can write off the cost of their properties to avoid paying taxes. Many properties that were built in the 1990s have already been fully depreciated, so landlords have already offset their costs and are milking these properties for maximum profit.

Nevada Realtors Financially Benefit from Home Sales

We know that Rent Stabilization laws are common sense reforms that protect renters from price-gouging, so you might wonder why the Nevada Realtors Association spent all the time and money to research, create, and market their anti-rent control website: www.truthaboutrentcontrol.com. When you look into the numbers, it becomes clear: Realtors have a vested interest in making renting difficult to justify purchasing a home.

Realtors in Reno make money from commissions, which are typically around 3% for both the buyer’s and seller’s agents. When an “average” home sells in Reno for $551,000, the agents earn a whopping $33,116.34 per house. When houses sell for up to $2 million in Reno, Realtors can make over $100,000 in a single transaction.

When landlords can charge whatever they want, apartment and condominium values skyrocket because they offer extremely lucrative profits. But it’s not just the landlords who get rich- the Realtors who facilitate these transactions are rewarded with massive commissions. That is why landlords and Realtors work hand-in-hand to artificially boost housing costs and hurt hardworking Reno renters.

We Need Your Help to Fight Back

The Reno Sparks Tenants Union is recruiting renters, volunteers, donors, and community leaders to join the fight for safe, dignified, and affordable housing for everyone. We invite you to get involved and follow us on Facebook and Instagram to keep up with the latest news affecting renters in Reno.